Who we are

No. 1 Broker in the Country Pioneering the Digital Edge in Broking Services

Why us

28

Years of experience in capital market

Since 1997

We are Revolutionizing the country’s brokerage industry with new ideas & innovations

Strong financial strength in the market

Strong IT Infrastructure

Service Coverage in key cities

Strongest corporate access

Years Of Trust

A great achievement

Happy Clients

Happy Clients

No. 1 Broker

For The Last 16 Years

Branches & Booth

All Over the country

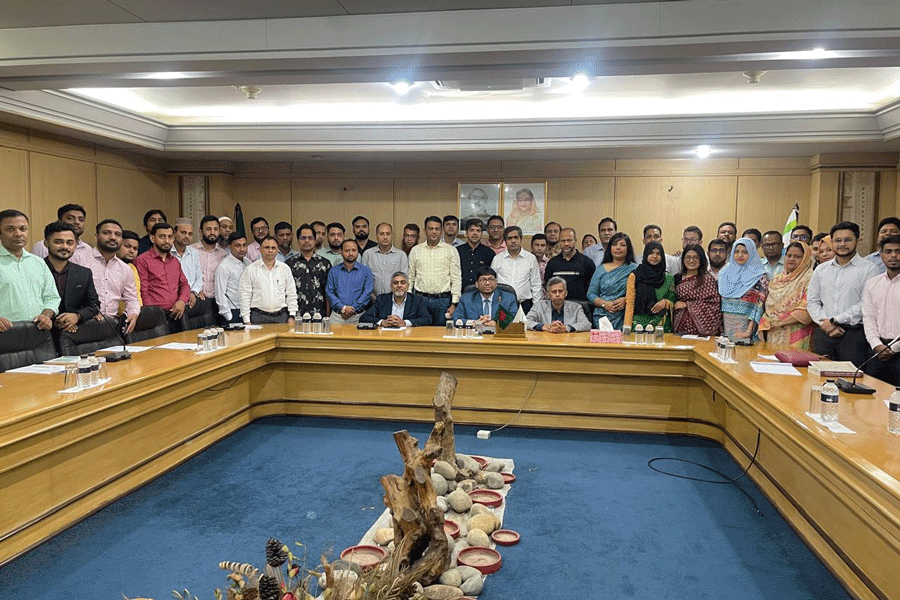

MANCOM

Management

Mr. Mohammed Nasir Uddin Chowdhury

Managing Director

....Read More

Mr. Khandoker Saffat Reza

Chief Executive Officer & Director

....Read More

Mr. S.A.R. MD. Muinul Islam

Chief Technology Officer & Director

....Read More

Mr. Mohammad Amir Hossain

Regional Chief, Chattogram

....Read More

Mr. Mohammad Shaidus Zaman

Head of Operations

....Read More

Mr. Mohammad Mahmud Elahi

Area Head - South

....Read More

Mr. Md. Mosharef Hossain

Area Head - North

....Read More

Mr. Saif Ahmed Chowdhury

Head of Risk Management

....Read More

Mr. Rehan Muhammad

Head of Institutional and Foreign Trade

....Read More

Ms. Kyrunnessa, FCMA, ACCA

Company Secretary & Head of Accounts & Finance

....Read More

Mr. Touhidur Nur

Head of Human Resource

....Read More

our specialization

Services

Brokerage Services

Margin Loan Facilities

Investor Relation Services

DP Services

Custodial Services

news

Latest News

Address

City Centre (13th Floor), 90/1 Motijheel, Dhaka - 1000

Let's Talk

Phone: +88 09678016792

Fax: +880-2-9563902

E-mail Us

info@lbsbd.com

How can we help you?

Fill out the form and we'll be in touch soon!

Twitter

LinkedIn

iBroker for Android

TradeXpress for Android

TradeXpress for iOS

DSEMobile for Android

Notice

LankaBangla Investments

LankaBangla Asset Management

LankaBangla Information System